If you’re aiming for a more cost-effective lifestyle, you might find it surprising that opting for a more expensive home over a median-priced one could be the way to go. While it may seem counterintuitive, let me explain.

Since purchasing a pricier home in the fourth quarter of 2023, my family and I have been grappling with the budgetary constraints it has brought about. However, instead of continuing to focus on the negatives, I’d like to now focus on the positives of owning an expensive home. The thought came to me after speaking with several real estate agents.

In 2024, bidding wars have made a comeback, fueled by a robust labor market, a thriving economy, pent-up demand, lower mortgage rates, and soaring stock prices. The downside of a bull market is that securing a favorable deal on a home becomes increasingly challenging. As people become wealthier, they tend to splurge on big-ticket items like cars and homes.

If your aim is to save money, you might want to steer clear of buying a home that falls within the median price range. Instead, strive to escape what I’ve dubbed the “frenzy zone,” which encompasses homes priced up to 150% of the median price in your city.

Once you venture into the territory of homes priced 50% higher than the median, demand tends to drop significantly. As you move further above the median price point, you’ll typically find better deals.

Conversely, the closer you get to the median price or below, the tougher it becomes to secure a favorable deal. This is because there’s a larger pool of individuals with household incomes sufficient to afford homes within this range.

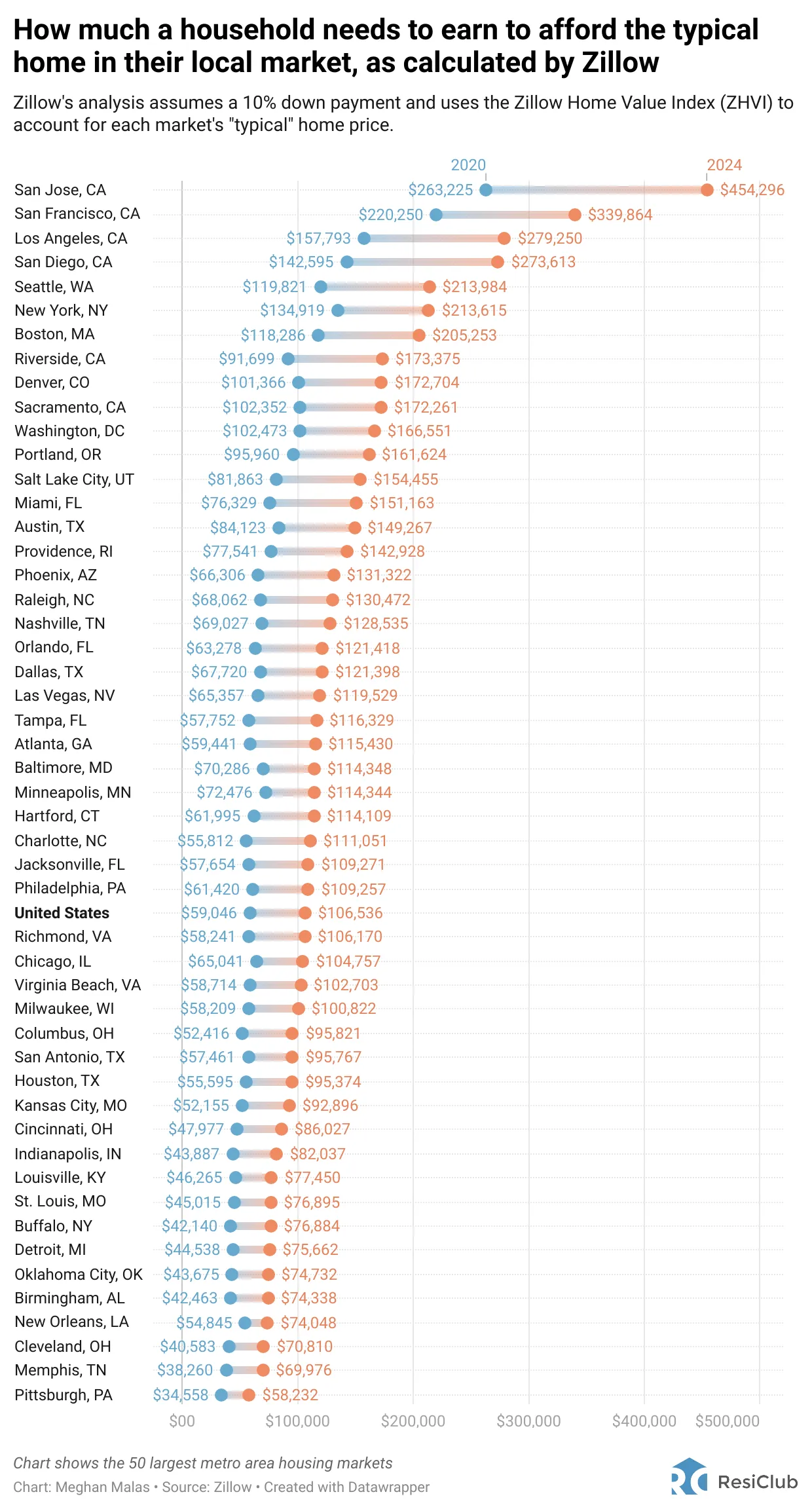

As a refresher, the chart below outlines the household income needed to afford a typical home (median-priced) in 50 cities, according to Zillow. To escape the frenzy zone and lead a more economical life, you’ll need to earn at least 50% more than the household income figures for 2024 to afford a home priced 50% higher than the median.

Let’s consider the overall United States figure of $106,536 required to purchase a median-priced home of around $420,000. To escape the frenzy zone and save money, you’ll need to explore homes priced above $620,000, necessitating an income of $160,000 or more.

While I can’t provide specific examples of how median-priced homes are selling across the nation, I can offer insights into the west side of San Francisco based on my research and discussions with top real estate agents specializing in the area.

Homes priced at the median level or below (under $1.7 million) on San Francisco’s west side are seeing robust demand. Here are a few examples of homes that hit the market and quickly garnered multiple offers, often selling well above the asking price.

Examples Of Median-Priced Or Below Homes Selling Way Above Asking

- 2455 22nd Ave: Received 32 offers in just one week, selling for over $450k above the list price. This 3-bedroom, 2-bathroom property spans 1,380 sqft, with a price per square foot of $1,200.

- 1335 28th Ave: Sold in one week for over $550k above the list price, with 21 offers. This 3-bedroom, 2-bathroom home covers 1,300 sqft, with a price per square foot of $1,277.

- 1755 11th Ave: Spent two weeks on the market and sold for over $300k above the list price. This 2-bedroom, 1.5-bathroom property spans 1,250 sqft, with a price per square foot of $1,295.

- 1736 11th Ave: Sold in two weeks for $195k above the asking price. This 2-bedroom, 1-bathroom home covers 1,075 sqft, with a price per square foot of $1,325.

These examples highlight the trend of modest homes attracting multiple offers and fetching high prices per square foot. It’s hard to imagine competing against 10 or even 32 other offers. No wonder some buyers feel compelled to bid well above the market value.

In such a fiercely competitive bidding environment, having an experienced buyer’s agent by your side is crucial to prevent potential financial losses. Despite the NAR settlement likely hurting the income of buyer’s agents, don’t overlook the importance of finding a good one to represent you if you lack experience.

While median-priced homes are cheaper in absolute dollars compared to luxury properties, they often prove more expensive when viewed from a value standpoint, particularly on a price-per-square-foot basis.

In the examples provided earlier, the price per square foot ranged from $1,200 to $1,325, which is 20% to 32% higher than San Francisco’s median price per square foot of around $1,000.

Generally, the more you pay for a home, generally, the more value you will get from a price per square foot basis (pay a lower price). The reason why is because people pay the most for necessities and less for luxuries or nonessentials.

For instance, the first full bathroom in a home typically holds more value than the eighth full bathroom. Same goes for the first bedroom versus the tenth bedroom.

Now let’s look at why smaller homes cost more on a price per square foot from a cost perspective. The most expensive parts of a house, per square foot, are kitchens and baths. The smaller the overall square footage of the house, the greater the proportion of square footage is baths and the kitchen. This drives up the price per square foot.

Economies of scale also plays a role in why larger homes tend to be cheaper on a price per square foot basis. When constructing a larger home, the cost per square foot may decrease due to shared walls, plumbing, the roof, and other infrastructure.

Higher Rental Yields With Smaller Properties

While the price per square foot for purchasing a smaller home is typically higher, it’s worth considering that smaller homes often yield higher rental returns if you plan to rent them out. This is because the rental yield of smaller properties tends to be greater. Additionally, there’s typically higher investor demand for smaller properties, which further contributes to their relatively higher prices.

Consider renting out a 1,500-square-foot, 3-bedroom, 2-bathroom single-family home in a Sunbelt city, which might yield an 8% cap rate. In contrast, an 8,000-square-foot, 7-bedroom, 7-bathroom single-family home in the same city might yield only a 4% cap rate. Then, if you take the mansion and drop it in an expensive coastal city, its cap rate might only be 2%.

By focusing on buying homes priced 50% or more above the median, you’re likely to encounter less competition and a reduced risk of entering bidding wars. Additionally, these higher-priced homes often trade at a lower price per square foot, offering potential savings in the long run.

We’re Seeing A Strong Middle Class

You might assume that higher mortgage rates would hit the median household income earner or lower the hardest, as they typically need to borrow the most and consequently pay the highest mortgage interest expenses. However, the robust demand for median-priced homes in San Francisco, and likely in other cities too, suggests otherwise.

The strength in demand indicates several things:

- The median household may be more financially healthy than we realize.

- It’s easier to accumulate a smaller down payment through personal savings and family assistance.

- There’s increasing upward pricing pressure for homes in the next segment up.

When the middle class shows confidence in the housing market, it bodes well for the economy compared to when only the top 1% are bullish. This is because the middle class constitutes a larger portion of the population with greater spending capacity, thus exerting a more significant impact on GDP.

Therefore, it’s wise to start considering homes priced above 150% of the median. In San Francisco, where the median home price is approximately $1.7 million, aiming for homes in the $2.55+ million range makes sense. Here, you’ll encounter less competition and receive better value by paying a lower price per square foot.

Over time, as the wave of households purchasing median-priced homes and those up to 50% higher gradually seeks to move up to the next tier, the median price per square foot of these pricier homes will also rise. And when the top 1% finally get as bulled up as the middle class, luxury home prices will explode higher once more.

The price per square foot of a house varies depending on factors such as location, finishes, age, architectural style, view, and lot size. Generally, the better these factors are, the more you’d be willing to pay per square foot.

Personally, I’m inclined to pay much more for a fully remodeled house with scenic views and ample outdoor space. After enduring a grueling 2.5-year gut renovation during the pandemic, I vowed never to undertake such a project again. The Remodeled homes should sell for greater premiums going forward given how difficult they are to complete.

With young children, having a large and secure lot where they can play freely is invaluable to me. In expensive cities, it is really the land that is valued the most. If you can find a house on a triple-sized lot or greater, you’ve found yourself a unicorn where you should try and lock it down.

Found Better Value In An Expensive House

Despite paying a substantial amount for my new home, I managed to secure it at a lower price per square foot compared to the examples mentioned earlier, even though my property is considerably nicer. This makes me feel like I received excellent value relative to the market.

I didn’t engage in a bidding war to acquire my home. Instead, I exercised patience and waited for two previous offers to fall through. Truth be told, I would have been willing to pay the original asking price, but I simply didn’t have enough funds at the time.

Then, I waited another year before submitting my own offer, which was 14% below the asking price and included inspection contingencies. Following this, we spent two and a half months meticulously inspecting every aspect of the property and ensuring that the seller addressed any necessary repairs or updates before our move-in.

When you perceive something as offering great value, it tends to feel more affordable than its actual price. Sure, my home’s price could absolutely go lower. However, it will take a large decline to erode my perception of the home’s value as I also feel the immense satisfaction of providing for my family.

The 14% savings I secured through patience could cover our family’s expenses for many years. Adopting this perspective helps me feel more comfortable with the high absolute price I paid.

Example Of Great Value If You Can Afford The Price

Below is an example of an expensive home in Presidio Heights where the buyer got a great deal. It was originally listed for $9,800,000 on February 13, 2023. After a month with no offers, the seller lowered the asking price to $8,900,000. Two weeks later, the seller lowered the asking price again to $6,995,000, when it finally sold for $7,340,000.

At $1,203/sqft, the home is great value for a buyer who could afford such a hefty absolute price. Presidio Heights is considered one of the most prime neighborhoods in all of San Francisco. Meanwhile, this home’s architecture and build quality are superior to the median-priced homes above, which all sold for a higher price/sqft.

Yes, I acknowledge buying in May 2023 was better than buying in March 2024, since the bottom of this real estate cycle looks to be in 3Q 2023. But the value is still there if this house were to sell today.

Look For Better Bargains Up The Home Price Curve

Given that all sensible homebuyers purchase within their financial means, purchasing this expensive home feels less expensive to me than it might for someone who got into a bidding war to buy a median-priced home. I know nobody who outbids 20 other bidders who then thinks they got a bargain.

So long as you comfortably buy a home less than what you think it’s worth, your life will feel more affordable. The price saving difference between what you paid and what you think your home is worth can be used to pay for a lot of life’s expenses.

Go up the price curve if you want to find a better deal on a home. Be patient as you earn and save more. If you bargain hard enough, you might just be able to find what you’re looking for.

Reader Questions And Suggestions

Have you ever felt your life got more affordable because you purchased a more expensive home? Why don’t more people go up the price curve to find better deals on a home by waiting longer, earning more, or borrowing more?

Please provide some color on how median-priced homes are selling in your city. I’d love to get a feel of how real estate demand is looking for median-priced homes around the country.

For those interested in passive real estate investment, consider exploring Fundrise. Managing over $3.3 billion, Fundrise focuses primarily on residential and industrial real estate investments in the Sunbelt region. With lower valuations and higher yields, the Sunbelt presents an appealing prospect due to demographic shifts catalyzed by technology and remote work trends.