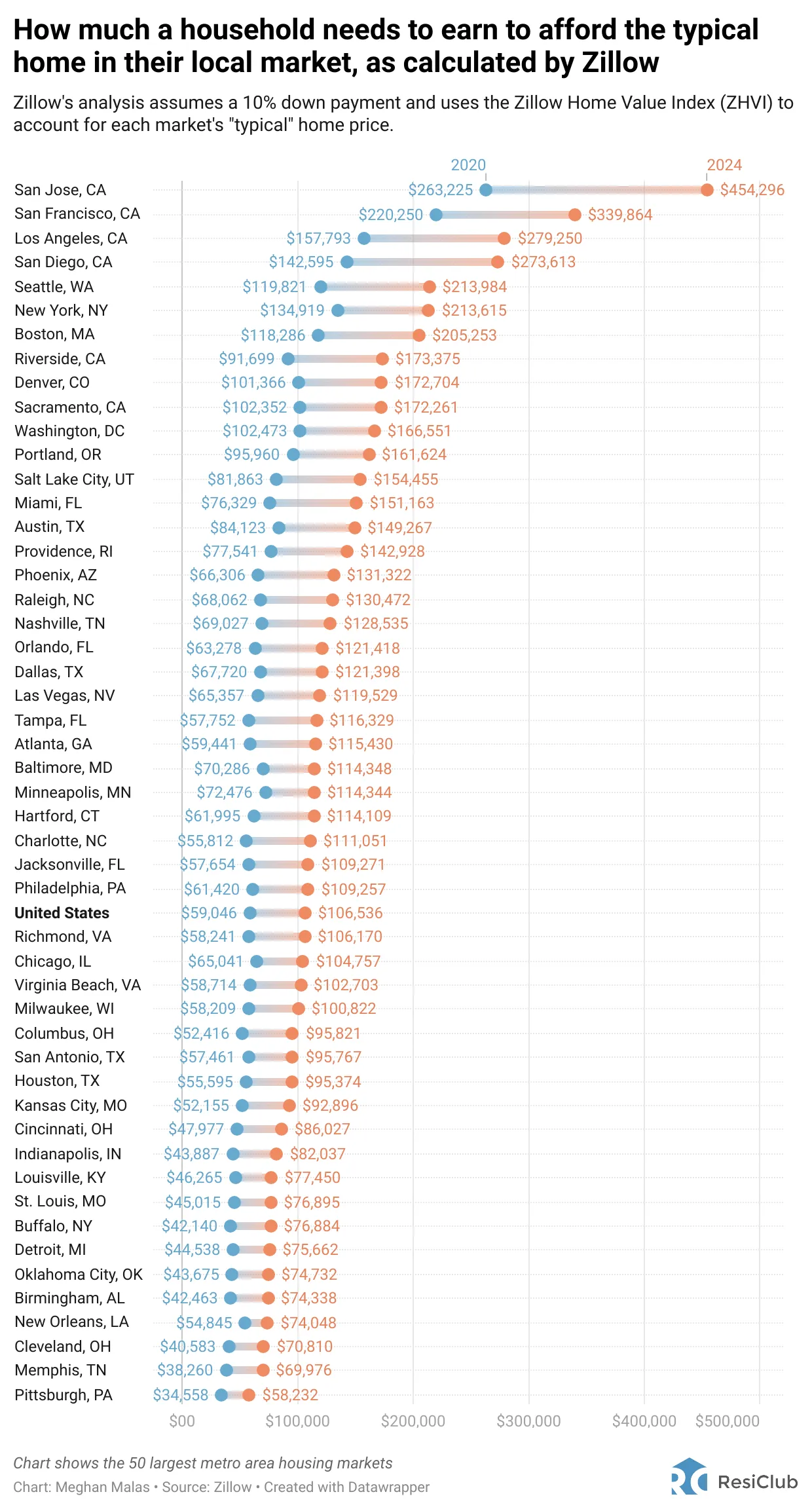

Zillow recently released an intriguing study that outlines the income needed to afford a “typical home” in different cities. The study considers a 10% down payment and utilizes the Zillow Home Value Index to determine the median home price in each city.

A 10% down payment is 10% lower than I’d recommend, but it’s Zillow’s exercise. Let’s compare the income required to purchase the median home in each city between 2020 and 2024. These are the top 50 city metros in America.

San Jose commands the highest income requirement to afford a median home at $454,296, while Pittsburg boasts the lowest income needed at just $58,232. If homeownership is a priority and budget constraints are a concern, perhaps a move to Pittsburgh, Pennsylvania, is worth considering!

As a San Francisco resident, I find it reassuring that the cost of living here is only $339,864. This represents a substantial $114,432 reduction in the required annual income, or 25%, compared to the income needed for homeownership in San Jose.

Furthermore, when it comes to lifestyle considerations, San Francisco offers a more picturesque, lively, and enjoyable environment compared to San Jose. It’s not San Jose that draws world travelers to the U.S., but rather the allure of San Francisco!

Expensive Cities Might Actually Be The Cheapest Cities To Live In

You’ve read my post titled “Why Households Need To Earn $300,000 A Year To Live A Middle-Class Lifestyle Today.” While you might have strongly disagreed with my analysis concerning families residing in expensive coastal cities, it’s reassuring to find external validation from Zillow supporting it.

The United States is vast, with varying cost-of-living levels across the country. Fortunately, we all possess the freedom to choose where we want to live.

If the cost of living becomes too burdensome for our income, we have the option to relocate, trim expenses, or seek additional work, as we are all rational decision-makers.

Despite cities such as Boston, New York, Seattle, San Diego, Los Angeles, San Francisco, and San Jose necessitating over $200,000 in household income to afford a typical home, I argue that these cities are more affordable than commonly perceived.

Here are two reasons why.

1) Expensive cities are cheaper to have fun and live healthier

As I wrote in my post about private sports clubs, I pay $180 a month to be a part of a network of clubs in the Bay Area. I think $180 a month is great value, which is why I’m unwilling to cut the expense despite no longer being financially independent.

Then Nate, a reader from Pittsburgh, PA chimed in and wrote,

“Very weird a private sports club with indoor pickleball and tennis would only cost $180/m. Obviously you wouldn’t cancel this. There is no such thing as private indoor sports club for $180/month in Pittsburgh. Only country clubs with outdoor tennis or pickleball and golf for $1,500/m and up. Other option is public park for tennis or pickleball which involves waiting/no reservations/no availability.”

Holy moly! $1,500 a month and up to be able to play tennis and pickleball indoors? No thank you! Who can afford that?

$18,000 a year for sports club membership dues while it only takes $58,232 in income to afford a typical house is an absurd ratio.

Nicer Weather Matters For Quality Of Life

Here in San Francisco, the weather remains moderate throughout the year, providing ample free public courts for tennis and pickleball. In this example, private sports club memberships are at least 88% more affordable.

For those seeking cost-effective outdoor enjoyment almost year-round, cities like San Jose, San Francisco, Los Angeles, and San Diego offer favorable conditions. However, in areas where the required income is less than the overall U.S. income of $106,536 to afford a home, maintaining a year-round outdoor lifestyle is more challenging.

Improved weather stands out as one of the crucial reasons why living on the West Coast surpasses living on the East Coast. Having experienced both coasts for over a decade each, I can attest to the significantly higher quality of life.

Life is already brief, and enduring three to four months of extreme winter conditions annually is suboptimal for many Americans. Consequently, a substantial number of Americans opt to relocate out west or south to Florida.

For those prioritizing favorable weather and homeownership, cities like New York City ($213,615) and Boston ($205,253) might not be the best choices.

Given their high-income requirements for housing and challenging weather conditions, a strategic move could involve geoarbitrage to more affordable and warmer cities on the east coast like Miami ($151,163), Raleigh ($130,472), Baltimore ($114,348), or even Pittsburgh, PA ($58,232).

2) Expensive cities are easier to make more money and thereby increase affordability

I’ve been contemplating a move to Honolulu, Hawaii since 2014.

After retiring in 2012, I thought, “Why not relocate to my favorite state in America?” The wonderful weather, delicious food, and laid-back vibe all seemed like factors that could contribute to a longer and more fulfilling life.

With enough passive income to sustain a simple lifestyle and the opportunity to generate supplemental retirement income through writing on Financial Samurai, the idea seemed appealing.

Back then, with no kids, retiring to Hawaii appeared to be a straightforward decision. However, my passion for real estate made me feel that if I were to move, I needed to own a home in Honolulu.

Just as shorting the S&P 500 long-term is considered a suboptimal decision, I believed that renting long-term and not owning real estate in Honolulu might also be less than ideal.

For three years, I diligently attended open houses in Honolulu during every visit to see my parents. Despite leaving each time excited about the potential of relocating, I couldn’t shake the fear that I might not comfortably afford to live in Honolulu.

Honolulu Housing Is ~30% Cheaper Than San Francisco Housing

It might seem strange to express concern about retiring in Honolulu, where comparable housing is about 30% cheaper than in San Francisco. Or is it?

My worry stemmed from the fear that if I purchased a home in Honolulu and encountered unexpected financial difficulties, I would find myself in a tight spot. In 2014, my passive income was around $110,000, which was already insufficient to qualify for a conventional mortgage for a median-priced home in SF or Honolulu.

Given my lack of W2 income, I would need to come up with a down payment of 50% or more to buy a home priced between $700,000 and $1 million. For context, the median home price in Honolulu is approximately $780,000, according to Zillow, but $1,075,000 according to Locations Hawaii, which seems more accurate.

And just like all median home price estimates, they seem way lower than the cost of the home you want to buy!

Pay Is Much Less In Honolulu Too

Upon exploring the job market in Honolulu, I discovered that the pay was 40% – 60% less than what I could earn in San Francisco. Moreover, I wasn’t aware of any attractive part-time consulting jobs in Honolulu.

In contrast, San Francisco boasted a plethora of consulting and full-time jobs paying $100,000 or more. Today, even 23-year-old college graduates working in tech, consulting, or finance can start earning $150,000 or more annually. It is only logical the highest-paying cities also have the highest cost of living.

According to Numbeo, you would need around $7,701 in Honolulu, HI to maintain the same standard of life that you can have with $8,900 in San Francisco, CA (assuming you rent in both cities). This calculation uses their Cost of Living Plus Rent Index to compare the cost of living and assume after income tax.

Buying Real Estate In San Francisco Felt Safer Due To Higher Income

Although San Francisco home prices are approximately 42% higher than Honolulu home prices, I felt more at ease purchasing a fixer-upper in San Francisco for $1,230,000 than buying a house in Honolulu for $700,000 – $1.1 million. I managed to buy the fixer in 2014 because a couple of large CDs matured, and my wife was in her final year of work.

I was confident that if I faced financial difficulties after buying the fixer in San Francisco, I could always secure a six-figure job as a consultant or full-time employee. San Francisco boasts a massive tech ecosystem, along with biotech, medical, aerospace, and tourism industries.

In contrast, Honolulu heavily relies on tourism as its main source of income. Therefore, economic challenges in Japan and China could adversely affect Honolulu. Making money in Hawaii is simply harder than making money in San Francisco.

Buying a home in San Francisco felt more secure due to the diversity of industries and the availability of higher-paying jobs. The ongoing artificial intelligence boom may also enhance the returns of my venture capital funds.

Additionally, if I didn’t live in San Francisco, I probably wouldn’t have had access to a couple of these private funds. All the top tier venture capital funds are invite only for retail investors because there is so much demand from institutional investors. Retail investors can only gain access to the “friends and family” round of employees.

Easier To Invest In Private Growth Companies Today

Thankfully, today, everybody who has $10 to invest can invest in the Fundrise Innovation Fund, an open-ended venture fund that invests in private growth companies in the AI space and more. I’m bullish on AI and I don’t want my kids asking me 20 years from now why I didn’t invest in the AI revolution near the beginning.

Here’s a conversation I had with Ben Miller, CEO of Fundrise about investing in private growth companies, which were once only accessible to ultra-high net worth individuals and institutions.

More Examples Of How Costs Are Higher In Cheaper Cities

Cost of Cars: The price of a Honda Accord remains consistent regardless of location. For instance, purchasing a $34,000 Honda Accord Sport would account for 58% of an $58,000 salary but only 23% of a job-equivalent salary of $150,000.

Cost of Materials for Home Remodel: Lumber, sheetrock, wiring, and fixtures generally cost the same across the country. Whether you’re remodeling a $500,000 house or a $1,200,000 house, the costs might differ (10% versus 5.8% of the home value, respectively). However, the higher-priced home yields a greater return on the remodel, considering the 120% higher price per square foot.

Cost of College: College tuition prices are consistent nationwide. However, the affordability of college has become challenging for middle-class families, particularly in cheaper cities, where only the rich or the poor can comfortably afford higher education.

Consider any product that maintains a consistent price regardless of your location, and you’ll understand why living in a more affordable city with a lower income can be more costly.

Living In An Expensive City Is Like Playing Offense

On your journey to financial independence, you have the option to play offense, striving to maximize your income, or play defense, aiming to save as much money as possible. Most individuals pursuing FIRE (Financial Independence, Retire Early) adopt a combination of both strategies.

Personally, I favor playing offense in wealth-building, driven by the unlimited potential for income and investment returns. Since 2009, I have chosen to reside in New York City and San Francisco, recognizing the abundant opportunities for higher earnings. This approach is akin to investing in growth stocks in the first half of your life.

Not only was I able to make more money living in NYC and SF, I was also able to build connections that granted me private investment opportunities, some of which have turned out well. Private company investments in names such as Figma and Ripple have blown past any stock index return over the past 10-20 years.

While the cost of living in these cities is undoubtedly high, it’s a reflection of the opportunities they offer. Owning real estate in such high-opportunity cities, once achieved, makes building more wealth much easier.

Relocate Once You’ve Made Your Fortune

After accumulating sufficient wealth, one can contemplate relocating to a more budget-friendly city that aligns better with lifestyle goals and income levels. It’s easier to move from New York City to New Orleans versus the other way around.

The income potential in an expensive city can be so substantial that the perceived drawbacks, primarily the high cost of living, become less significant.

If you live in an affordable city, all the more reason to capitalize on online income and work from home opportunities. Fortunately, an increasing number of jobs now offer comparable wages regardless of your location. Therefore, you might as well take advantage!

Reader Questions And Suggestions

Is living in an expensive city truly more cost-effective? Are people overlooking the fact that these cities are expensive because of the income opportunities they offer? Which cities do you think strike the best balance between affordability and income potential?

I plan to continue investing in the heartland of America, where the cost of living is lower and rental yields are higher. Technological advancements will drive more Americans to relocate to more affordable cities over the next several decades.

If you share this long-term demographic change perspective, take a look at Fundrise. Managing over $3.5 billion in assets, Fundrise primarily invests in residential and industrial properties in the Sunbelt region. If you choose to remain in an expensive city, all the more reason to diversify across less expensive parts of the country.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise funds. Since 2016, I’ve invested $954,000 in a variety of private real estate funds and individual deals to diversify away from my expensive San Francisco holdings and earn more passive income.

Financial Samurai is one of the largest independently-owned personal finance sites with roughly 1 million organic visitors a month. The site was started in 2009 with everything written based off firsthand experience. Sam worked in finance for 13 years, got his MBA from Berkeley, and has written over 2,300 articles since 2009. He is also the WSJ bestselling author of Buy This Not That.