StellarFi

Product Name: StellarFi

Product Description: StellarFi is a service that can help you build credit when you pay your regular bills. There is no free version and the entry plan, Lite, costs $4.99 per month and lets you report up to $500 in bills as credit.

Summary

StellarFi first started offering its service in July of 2022, so it’s a relatively newer company, but has shown results with some customers. It is structured as a Public Benefit Corporation, which means it’s mission (and mandate) is to help consumers and not maximize profits for shareholders.

Pros

- May improve your credit score within the first few months

- Builds credit by paying the bills you already have

- No hidden fees, deposits, or interest charges

- Access to free financial and credit education

Cons

- No free plan

- Does NOT report to TransUnion

- Limited customer service availability

StellarFi is a credit builder platform that doesn’t require you to borrow money, pay interest, or make any security deposits. Instead, it converts your regular monthly bills into a powerful credit-building tool.

But how does it compare to the many credit-building products available on the market, and does it really work?

Give us a few minutes and we’ll explain how the platform works, how much it costs, and how it can help you build credit.

At a Glance

- Use StellarFi to pay your bills and then immediately pay StellarFi back

- Reports to Equifax and Experian

- Plans start at $4.99 per month

Who Should Use StellarFi?

StellarFi is good for people who want to rebuild their credit and have monthly bills they already pay via their checking account. Plans start at just $4.99 per month for up to $500 in bills per month. The next level plan is $9.99 per month and works for bills up to $25,000 per month, which should cover most people.

StellarFi Alternatives

|

|

||

| Pricing | $5 per month | Charges interest | Charges interest |

| Build credit with current bills | No | No | No |

| Builds savings | No | Yes | Yes |

| Learn more | Learn more | Learn more |

Table of Contents

StellarFi is a credit-building service that opened to the public in July 2022. According to the financial technology (fintech) platform, over 130 million Americans don’t have access to a homeownership path or a financial safety net to afford emergencies.

One of the key selling points is that it allows you to build credit without a credit card by reporting your monthly payments to two of the major credit bureaus (Equifax and Experian). Furthermore, you won’t undergo a hard credit check which has a slight impact on your credit.

Also, it’s structured as a Public Benefit Corporation, which is a specific corporate structure in which they affirm to “generate social and public good.” Its mandate is to generate good rather than maximize shareholder profits (or other similar motives).

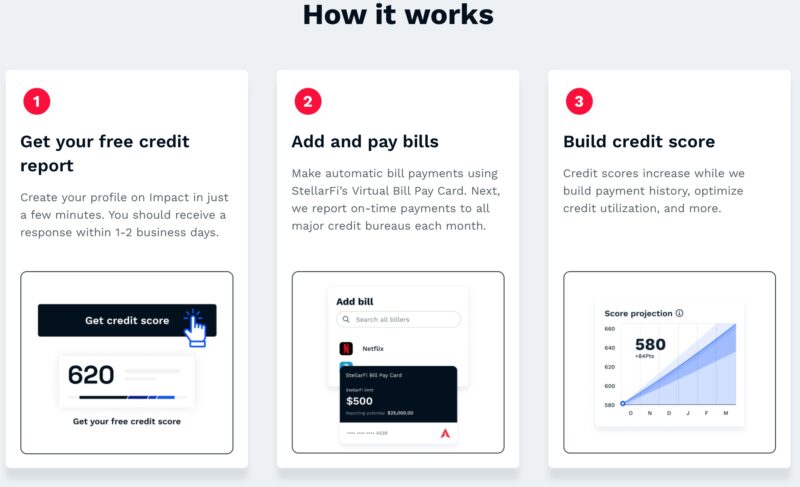

How StellarFi Works

Getting started is easy. You simply connect your monthly bills to a StellarFi Bill Pay Card, which acts like a line of credit. This credit line pays your bills and immediately draws the funds from a linked bank account, so you never carry a balance or pay credit card interest.

StellarFi has been adding additional perks as its customer base expands. This includes bill payment rewards and other perks on its upper-tier plans.

Let’s take a closer look at how you can bolster your credit score.

Free Credit Report

You can check your credit score for free after creating your StellarFi profile (there is no impact on your credit.) This provides a baseline from which to track your progress with each bill payment.

Your StellarFi credit score is a Vantage 3.0 scoring model from the three bureaus. Most credit score apps only monitor one or two scores.

One minor frustration is that you see a Vantage 3.0 credit score instead of a FICO Score, which is the most common credit score. The FICO Score is the one the lenders use when they perform a credit check. So, the VantageScore isn’t as precise, but you have a firm idea of your current credit score range.

Add and Pay Bills

After completing the initial account setup, you can link your recurring monthly bills, such as your cable TV, internet, or phone bill. You receive a virtual StellarFi payment card that you can provide the biller to pay the monthly tab.

StellarFI’s auto-connect feature lets you quickly update your payment method with most national brands. You can also manually link bills with merchants with whom StellarFi doesn’t have a direct relationship.

In addition to linking bills, you connect your checking account to StellarFi to pay bills. There are no additional fees to use this service, such as payment processing fees or bank transfer fees. When a bill is due, StellarFi will check your bank to ensure there are sufficient funds to pay the bill. If there aren’t sufficient funds, the bill will not be paid.

Improve Your Credit Score

By paying your bills through StellerFi, you establish a positive payment history, as you would with a credit builder loan. You pay your bills with the StellarFi card, which technically borrows money from StellarFi, and then StellarFi immediately withdraws the funds from your checking account to cover the payment.

Your positive payment history will be sent to two of the major credit bureaus, Equifax and Experian.

This reporting is similar to the free service offered by Experian Boost. However, Boost only improves your Experian credit score. It won’t help you build credit with Equifax or TransUnion.

You may notice a temporary drop in your credit score when you first join StellarFi, as the line of credit appears as a new account on your credit reports. A brand-new credit account negatively impacts your average length of credit history (15% of your total credit score) and new credit factors (10% of your total score).

You can get similar results by paying your bills with a secured or unsecured credit card. However, a credit card isn’t ideal if it encourages you to overspend or you end up paying high credit card interest rates. It also will not immediately take the money out of your checking account when you pay a bill, although you can always manually pay the card at any time.

It can also be difficult to qualify for a credit card if you have bad or fair credit.

Other StellarFi credit-building tools include:

- Creating customized credit goals

- Credit score simulator

- Debt-to-income (DTI) calculator

- Dynamic score projections

✨ Related: How to Increase Your Credit Score

StellarFi Plan Pricing

StellarFi offers three paid plans and has no free version.

The big difference between the plans is the amount in bills that is reported as credit. You can upgrade to a higher plan to access a higher credit limit, which may help you minimize your credit utilization ratio and pay more bills.

| Plan Name | Monthly Fee |

Total Payments |

|---|---|---|

| Lite | $4.99 | $500 |

| Prime | $9.99 | $25,000 |

| Premium | $29.99 | Pay unlimited bills |

Lite

The entry-level Lite plan costs $4.99 monthly and allows you to report up to $500 of bills as credit. Your initial line is smaller until you complete your first bill payment before it expands to $500.

With Lite, you can access other essential features, including bill pay auto-withdrawal, bill payment notifications, credit score monitoring and alerts, 1-on-1 live credit coaching, and more.

Prime

StellarFi’s mid-tier plan is called Prime, and it costs $9.99 monthly after a $0.99 trial for the first 30 days.

Up to $25,000 in bills can be reported as credit, a significant increase over the Lite plan.

Premium

StellarFi Premium is the highest-tier plan and costs $29.99 monthly, which lets you pay an unlimited number of bills.

According to StellarFi, the Premium plan will include the following exclusive benefits:

- Paying with ACH transfers (as some merchants don’t accept card payments)

- Flexible bill payment dates (Pay bills early and repay StellarFi within 60 days interest-free)

- Identity protection system (SSN monitoring, ID theft insurance and restoration, credit report dispute, and more)

Is StellarFi Safe?

StellarFi encrypts your personal data using bank-level 256 AES security. The platform also uses randomized digital tokens and never stores your financial information.

With that said, tech glitches do occur, and there are times when bill payments may not be completed as scheduled. If that happens, StellarFi will make it right by reimbursing any late fees and protecting your privacy.

Remember that StellarFi is a young company, so you must be comfortable dealing with a startup.

Does StellarFi Work?

You can benefit the most from StellarFi if you have a credit score in the low 600s or below.

Here are some reported results from StellarFi users on Trustpilot:

- Adrian N. reported an average 40-point increase after the first month

- Angel M. reported an average 45-point increase over 4-6 months.

- Caitlynn D. reported a 20+ points boost during the first 30 months.

- Destany B. reported a 28-point increase after the first month and zero points after the second month before leaving their review.

Remember that these are online reviewers, and their results cannot be substantiated.

Also, from Trustpilot, the most common StellarFi complaints tend to surround a lack of customer service options. Several reviews indicate that chatbots handle the initial inquiry process, and it can be difficult to reach a human.

Ultimately, you can’t rely on StellarFi alone to strengthen your credit history. You must also focus on paying your existing loans and credit cards on time, avoiding opening new credit cards or loans and keeping existing credit card accounts open as long as possible to maximize benefits.

Credit Building Alternatives

Credit building services aren’t new, and the market is full of similar services.

Here are a few StellarFi alternatives:

Kikoff

Kikoff is a credit-building platform that offers a credit account as well as a secured credit card. The Kickoff Credit Account is a $750 credit line. Instead of paying bills, you can buy financial education products, and your payment activity reports to the three bureaus.

Two additional tools are a secured credit card and a credit builder loan. Kickoff’s Credit Service charges a flat, $5 monthly fee, but unlike some competitors, it doesn’t charge any fees for its secured card or credit builder loan product.

Here’s our full Kikoff review for more info.

CreditStrong

You can improve your personal or business credit through CreditStrong. Several credit builder loan tiers are available depending on how aggressively you want to increase your score and your monthly budget.

Check out our CreditStrong review to compare credit-building plans.

Self

Self lets you deposit monthly payments into an FDIC-insured certificate of deposit (CD). The credit builder loan’s repayment term is as long as 24 months with a monthly commitment between $24 and $150. Each payment reports to the three major bureaus, and you are reimbursed the contribution amount at the maturity date, excluding fees.

Additional products include a secured credit card and free rent reporting.

Read our Self Credit Builder review to find out more.

FAQs

Does StellarFi do a hard credit inquiry?

No hard credit check is necessary to apply as you only need a Social Security number or individual taxpayer identification number (ITIN) to report payments to your credit bureaus.

How does StellarFi show up on a credit report?

Your StellarFi account appears as a revolving line of credit similar to a credit card. Each month, the platform reports your monthly bill payment amount and compares it against your total limit to calculate a credit utilization ratio.

How do I cancel StellarFi?

You can pause or cancel your account by accessing the “manage account” button in the personal information menu. Pausing your account keeps your line open to prevent an account closure from appearing on your credit report, but it no longer reports monthly payments as you’re not paying a membership fee anymore.

What are the StellarFi customer service options?

Chat and email support is available from 8 a.m. to 6 p.m. Central from Monday to Friday. Live phone support is unavailable unless the platform contacts you to schedule a call.

Is It Worth It?

StellarFi is worth considering if you’re looking for a way to build or repair your credit without a secured credit card or other credit product. One of the biggest advantages of using StellarFi is that it helps you automate your finances and report your bill payments to two major credit bureaus, Experian and Equifax.

Just be mindful of the fees – unfortunately, StellarFi does not offer a free tier – and be realistic about how much StellarFi can boost your credit score. Remember that you will have to stick to sound credit-building practices, such as timely credit payments and regular budgeting, to stay on track for financial success.

Other Posts You May Enjoy:

SoFi® Checking & Savings Review: A Bank Account with a Cash Bonus

SoFi Money Product Name: SoFi Money Product Description: SoFi’s bank account is a checking and savings combination that earns a…

5 Best Banks That Don’t Use ChexSystems

Chexsystems is like a credit-reporting agency for bank accounts. Unfortunately, a low Chexsystems score can make it difficult to open a checking account. If you’re struggling with a low Chexsystems score, here’s a list of fifteen banks that don’t use Chexsystems, where you can open an account.

How to Convert Visa Gift Cards to Cash

Gift cards are great, especially when you get them for free. But sometimes, you just need cold, hard cash to pay the rent, send a friend some money, or catch up on some bills. In this article, I’ll show you how to convert your Visa gift card to cash.

Apps Like Earnin: 6 Earnin App Alternatives for 2024

Earnin is a popular fintech app designed to give you early access to your paycheck without a high-interest payday loan. Other features include low balance alerts and the chance to win free cash when you put money into savings. But Earnin isn’t the only app of its kind. Here are 16 other apps that provide similar features to Earnin.

About Josh Patoka

After graduating in $50k with student loans in May 2008 from Virginia Military Institute with a B.A. International Studies and Political Science with a minor in Spanish (he studied abroad in Sevilla, Spain for 3 months), Josh decided to sell his soul for seven years by working in the transportation industry to get out of debt ASAP and focus on doing something else with a better work-life balance.

He is a father of three and has been writing about (almost) everything personal finance since 2015. You can also find him at his own blog Money Buffalo where he shares his personal experience of becoming debt-free (twice) and taking a 50%+ pay cut when he changed careers.

Today, Josh relishes the flexibility of being self-employed and debt-free and encourages others to pursue their dreams. Josh enjoys spending his free time reading books and spending time with his wife and three children.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.