In a world where uncertainties seem to multiply by the day, one profession stands at the forefront of safeguarding businesses and steering them confidently through turbulent waters: risk management. As industries grapple with everything from economic volatility and climate change to cybersecurity threats and global health crises, the demand for skilled risk managers has surged to unprecedented heights. If you’ve ever considered a career that not only offers job security but also the opportunity to make a meaningful impact, now is your moment! Join us as we explore why entering the field of risk management today could be one of your smartest moves yet—where foresight isn’t just an asset; it’s a necessity. Whether you’re looking for a career change or starting fresh, let’s dive into the compelling reasons this dynamic field needs passionate problem-solvers like you!

Introduction to the field of Risk Management

In today’s fast-paced world, the landscape of business is shifting rapidly. With increasing complexities and uncertainties, organizations are turning to a critical yet often overlooked profession: risk management. As companies face rising threats from cyber-attacks, regulatory changes, and market volatility, the demand for skilled risk managers has skyrocketed. This field offers an exciting opportunity for those looking to make a meaningful impact while enjoying robust career prospects.

If you’ve ever wondered how businesses anticipate potential pitfalls or navigate through crises with confidence, you’re on the right track. Risk managers play a pivotal role in safeguarding their organizations’ futures. Whether you’re considering a fresh start or seeking to elevate your current career path, now might be the perfect time to explore insurance and risk management careers that promise not just job security but also personal fulfillment.

Understanding the role of a Risk Manager

A Risk Manager plays a crucial role in identifying, analyzing, and mitigating risks that could impact an organization’s financial health or operational efficiency. These professionals assess potential threats—ranging from market fluctuations to regulatory changes—and develop strategies to minimize their effects.

Effective communication is vital for Risk Managers. They collaborate with various departments, ensuring everyone understands the risks involved in their projects and initiatives. This cross-departmental interaction fosters a culture of risk awareness within the organization.

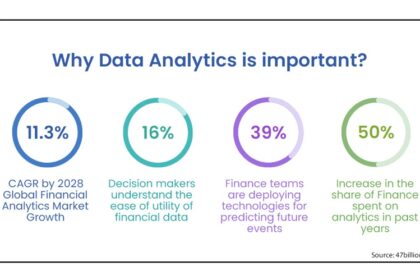

Data analysis forms the backbone of a Risk Manager’s work. By leveraging data-driven insights, they can predict possible future scenarios and create contingency plans accordingly.

Furthermore, staying updated on industry trends is essential for success in this role. The ever-evolving landscape requires adaptability and foresight in order to safeguard an organization’s interests effectively.

The growing demand for Risk Managers in today’s market

The landscape of business is evolving rapidly, and with it comes an increased focus on managing risk. Organizations are recognizing that effective risk management is crucial for sustainability and growth.

As businesses face more complex challenges—from cyber threats to regulatory changes—the demand for skilled Risk Managers has surged. Companies across various sectors now prioritize hiring professionals who can identify vulnerabilities and implement strategies to mitigate them.

This heightened awareness has led to a significant shortage of qualified Risk Managers in the market. As organizations grapple with uncertainty, they seek experts who can navigate these turbulent waters effectively.

Moreover, industries such as finance, healthcare, and technology are expanding their risk management teams. This trend underscores the essential role these professionals play in ensuring operational stability and compliance.

With companies investing heavily in risk management practices, it’s clear that the opportunities in this field are abundant and growing each day.

Benefits and salary potentials of a career in Risk Management

A career in Risk Management offers numerous benefits that make it an attractive path for many. First, job stability is a significant advantage. As businesses face increasing uncertainties, skilled risk managers are essential.

The salary potential in this field is also impressive. According to recent data, entry-level positions can start around $60,000 annually. With experience and specialization, salaries can exceed $120,000 or more.

Additionally, the opportunity for bonuses and incentives adds to the overall compensation package. Many companies recognize the value of effective risk management and reward their professionals accordingly.

Job satisfaction often comes from knowing your work directly impacts an organization’s success. You’ll play a crucial role in safeguarding assets while fostering growth opportunities.

Lastly, flexible working arrangements are becoming common within this sector—offering remote options that support work-life balance.

How to become a Risk Manager: education and certification requirements

To become a successful Risk Manager, education is the foundation. A bachelor’s degree in finance, business administration, or a related field is often required. This provides essential knowledge about risk assessment and management principles.

Many professionals pursue advanced degrees for added credibility. A Master of Business Administration (MBA) with a focus on risk management can enhance your prospects significantly.

Certification can set you apart in this competitive landscape. The Certified Risk Management Professional (CRMP) designation is highly regarded. Other certifications like the Financial Risk Manager (FRM) also carry weight.

Practical experience is equally vital. Internships or entry-level positions in financial services provide valuable insight into real-world applications of risk management techniques.

Networking plays an important role too. Joining professional organizations opens doors to resources and mentorship opportunities that can guide your career path effectively.

Day-to-day responsibilities and challenges faced by Risk Managers

Risk Managers wear many hats in their daily roles. They assess potential threats to an organization, evaluating everything from financial risks to compliance issues. This requires a keen eye for detail and strong analytical skills.

Communication is key. Risk Managers liaise with various departments, ensuring everyone understands the risks involved in their operations. They often create reports that outline risk assessments and recommend strategies for mitigation.

Challenges abound in this field. Rapid changes in regulations or market conditions can make it difficult to stay ahead of potential issues. Additionally, balancing risk management with business objectives is no easy feat; it often involves tough decisions that impact overall strategy.

Adapting to new technologies adds another layer of complexity. Keeping up-to-date with software tools designed for risk analysis can be daunting but essential for effective performance in today’s landscape.

Impact of technology on the field of Risk Management

Technology is revolutionizing the field of Risk Management in profound ways. Advanced analytics and big data allow risk managers to identify potential threats with unprecedented accuracy. This shift transforms how organizations assess vulnerabilities.

Automation tools streamline processes, minimizing human error. Tasks that once took days can now be accomplished in hours, freeing up professionals for strategic decision-making.

Artificial intelligence plays a crucial role as well. AI algorithms analyze patterns and predict risks faster than traditional methods ever could. These insights empower firms to respond proactively rather than reactively.

Cybersecurity has become paramount, too. With increasing digital transactions comes the need for robust frameworks to safeguard sensitive information against breaches.

Moreover, cloud-based solutions enhance collaboration among teams located worldwide. Real-time access to critical data fosters better communication and informed decisions across all levels of an organization.

The integration of technology into Risk Management not only increases efficiency but also enhances the overall effectiveness of strategies employed by risk managers today.

Career progression opportunities in the field

Career progression in Risk Management is both dynamic and promising. Many professionals start as junior risk analysts, where they gain foundational knowledge of the industry.

With experience, they often move into roles like Risk Manager or Compliance Officer. These positions involve strategic decision-making and policy formulation, offering a chance to influence their organization’s direction.

For those seeking more responsibility, Senior Risk Manager or Director of Risk becomes attainable with proven expertise. These high-level roles require strong leadership skills and an ability to navigate complex regulatory environments.

Additionally, specialists can branch out into niche areas such as cybersecurity risk management or enterprise risk management. This specialization opens doors to consulting opportunities or executive positions within larger organizations.

Continuous education plays a crucial role in career advancement too. Staying updated with certifications and emerging trends ensures that professionals remain competitive and adaptable in this evolving field.

Tips for success as a Risk Manager

Success in risk management requires a blend of analytical skills and interpersonal abilities. Start by honing your critical thinking. This skill helps you assess situations from multiple angles.

Communication is essential. You’ll often need to convey complex information to stakeholders who may not have a technical background. Tailoring your message can make all the difference.

Stay updated with industry trends and regulations. The landscape is ever-changing, so continuous education through seminars or certifications can enhance your expertise.

Networking also plays a crucial role in career advancement. Engage with fellow professionals through conferences or online forums to share insights and strategies.

Lastly, embrace technology tools that streamline processes and improve accuracy in risk assessments. Familiarity with software solutions can set you apart from others in the field while making your work more efficient.

Conclusion

As industries and businesses continue to face challenges and uncertainties, there is an increasing need for risk managers who can identify potential risks and develop strategies to mitigate them. This provides a great opportunity for individuals looking to enter the field of risk management. With the right education, skills, and experience, one can excel in this expanding profession. It’s never too late to start a career in risk management, so seize the moment and embark on a fulfilling journey in this dynamic field.