Bullion refers to Precious Metal products sold as coins, bars, or rounds and valued based on their precious metal content rather than face value.

Bullion can offer investors protection against inflation and devaluation of fiat currencies, making it an attractive diversification asset. Understanding what makes bullion so special and valuable will enable you to create an investment strategy.

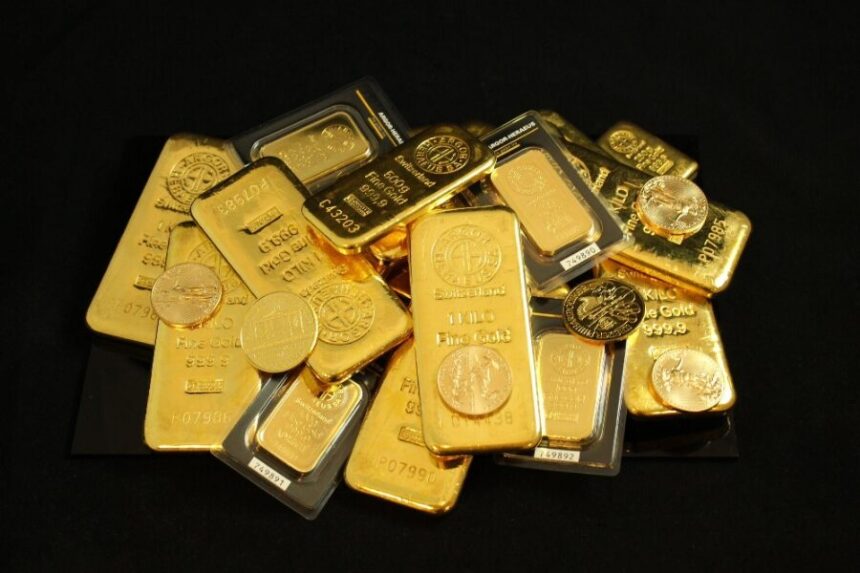

Bullion investments consist of coins, bars, and rounds crafted out of precious metals such as Gold, Silver, and Platinum. Bullion provides diversification strategies that help to protect purchasing power in times of crises while safeguarding wealth; often used as an alternative to fiat currencies that may experience inflation or devaluation.

Bullion can be purchased in physical or paper form and stored either at home, with a bank, or through third-party storage services. It can also be traded on exchanges; most commonly sold as coins and bars that meet specific purity levels to qualify as bullion.

Its name derives from Anglo-Norman melting house terminology as well as French “bouillon,” meaning boiling. Historically fire assay was employed along with modern spectroscopic testing techniques in testing quality bullion products; both practices continue today to determine its quality.

When buying bullion, the ideal method is through an authorized bullion dealer or broker. Reputable dealers only sell certified precious metals certified by the London Bullion Market Association (LBMA). This ensures that you receive genuine precious metals without tainted or remelted pieces. Furthermore, they will store physical metal for you in an allocated account, so you have full legal ownership.

It is a form of diversification.

Bullion investments encompass Gold, Silver, and Platinum coins, bars, and rounds. Each coin’s value depends on how much precious metal it contains; gold bullion tends to be worth far more than its face value, providing great diversification benefits in any portfolio.

Gold has experienced exponential value appreciation due to its reputation as a haven in times of economic instability and is often used as an insurance policy against inflation or currency risks. This is why, when considering diversifying into these types of holdings, understanding what is bullion is vital. There are various methods for investing in gold or silver bullion; one way is buying physical bullion to safeguard savings and purchasing power in the event of global financial crises.

Palladium or Platinum investments may also appeal to investors; however, these products are less widely available than gold or silver bullion.

Bullion refers to nonferrous metals refined to an extremely high purity standard for centuries-old fire assaying techniques and modern spectroscopic analysis; its purity can be assessed through both ancient and modern means such as fire assaying techniques as well as modern spectroscopic technology for assessment purposes.

Bullion comes in various forms including 1 oz. Precious Metal coins and bars as well as smaller options such as 1/10oz Gold/5oz Silver coins and 1/4oz Platinum/Palladium bars for investment options.

It is a form of insurance.

Bullion is an invaluable precious metal investment used as a hedge against inflation. Investors can purchase it either through an exchange, private dealer, ETF funds, or products that track an index like gold and silver prices.

Oxford English Dictionary defines bullion as a precious metal in bulk form that can be valued by weight, typically seen in bars and rounds but also minted into coins with face values. Bullion is often held by central banks as reserve assets during economic turmoil as an asset class to protect investors against volatility. You can click the link: https://www.drs.wa.gov/understanding-market-volatility-newsfeed/ to learn more about market volatility.

Many believe buying bullion is an effective way to hedge against inflation; however, its investment risks should be carefully evaluated. While the return can be high initially, rising prices quickly reduce returns while devaluing commodities over time.

Bullion refers to precious metals with certain purity levels and weight requirements, typically gold which must meet at least 99.5% purity to qualify as investment grade and be approved for trading by the London Bullion Market Association or similar markets worldwide.

It is a form of currency.

Gold bullion is a form of precious metal traded on the commodities market. As a physical product such as coins, bars, or rounds it offers protection from financial crises and inflation; many countries stockpile gold reserves in their reserves for safe-haven purposes during times of turmoil and inflation.

Since 2008’s financial crisis, it has become an increasingly popular investment choice leading to gold’s rising prominence in diversifying portfolios with gold bullion as one of its facets.

Bullion items’ values are determined by weight, purity (karat level), rarity, and price; often sold at a premium over spot prices for precious metals like gold. You can learn more about karats by clicking the link. Investors seek bullion as diversification assets to hedge against economic uncertainty.

Bullion value can be affected by many different variables, including demand and supply, trading frequency, and political situations. While gold may seem to be one of the more stable precious metal investments, its worth can still fluctuate due to market conditions such as when prices increase or when an economy experiences a downturn.

Gold bullion investing can be an excellent way to diversify your portfolio and protect against inflation, but it is crucial that you understand its nuances before making any purchases – whether buying physical bullion or investing via Precious Metals IRA. This is why it is essential for any potential investors to thoroughly research their options before committing to a plan.